Online payment processing…

… is a crucial segment in the interactive gambling industry, with players relying heavily on reliable payment methods. This is crucial both for getting the most out of their set bankrolls, and in order to cash out the maximum winnings amount possible. Casino operators have identified the potential behind this need for the optimal online payment processing solution, and continuously work to provide players with the best options available in the market.

… is a crucial segment in the interactive gambling industry, with players relying heavily on reliable payment methods. This is crucial both for getting the most out of their set bankrolls, and in order to cash out the maximum winnings amount possible. Casino operators have identified the potential behind this need for the optimal online payment processing solution, and continuously work to provide players with the best options available in the market.

Inpay is one such option…

… that has definitely gained great popularity since its initial launching. To be more specific, it is a financial service that guarantees to process payments in both directions. Users are able to send and receive money through a fully optimized system of centralized recording and local bank transfers.

It was founded…

… back in 2007 by founder and current owner of the private company, Jacob Tackmann Thomsen. As stated on the official website of the service, Thomsen is a ‘pioneer in online data security’, which is most reflected in this service’s optimized operations. He, along with a staff of highly-skilled experts in the field have developed and currently provide payment processing services by combining the best of the Fintech world and the established world of banking.

More specifically, Inpay…

… functions on the basis of a centralized register that receives, records and acts upon payment processing requests from multiple locations worldwide. It is further connected with local banking institutions in over 60 countries through established accounts, as well as branch offices in the United Kingdom, the Philippines and Singapore. Naturally, it has retained its headquarters in its country of origin, the city of Copenhagen in Denmark, where it all started.

Among other countries, users of this service can send and receive payments from:

- Australia

- Austria

- Belarus

- Belgium

- Brazil

- Canada

- Chile

- Croatia

- Denmark

- Egypt

- Finland

- France

- Germany

- India

- Italy

- Jordan

- Mexico

- Morocco

- Netherlands

- Norway

- Romania

- Russian Federation

- Sweden

- Turkey

- United Arab Emirates and

- Vietnam

Aside from the apparent advantage in terms of global availability…

… of the service, it also boasts great legal compliance with the legal systems of each of these jurisdictions. What is more, Inpay is regulated by the Financial Supervisory Authority (DFSA No. 22008), which speaks volumes considering the rigorous requirements of the institution. All in all, Inpay has definitely paved the way for its revolutionary model of payment processing, as illustrated in greater detail below.

How Inpay works?

As it has already been mentioned, Inpay works…

As it has already been mentioned, Inpay works…

… on a whole new and revolutionary principle of payment processing. The company has achieved its goal, setting out to combine the best of the modern world – its technologic progress and the established security, maturity and reliability of the standard world of banking.

Speaking of banking, they have identified banks and established financial institutions as the pillar of such operations for as long as they existed.

As a result…

… the company aimed to incorporate their reliability in the new product – they partner with leading banking and financial institutions in multiple countries all over the world. The service opens a banking account with the specific bank, and is able to provide payment processing services to the residents of the country through local banking transfers.

Alternatively…

… when speaking about international payment processing, they have further employed a high-end technology of a centralizing recording system. In other words, the company has a central registry that is able to receive the payment processing requests coming from all over the world and then redirect them to the specific target country. There, Inpay will complete the transaction using their own banking account, through the local online banking system.

However, before any of this is completed, the company employs…

… strict and in-depth inspection of the funds processed, and ensures their secure transfer.

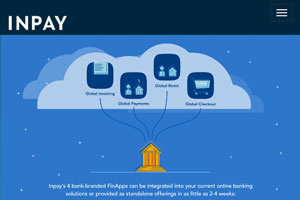

So far, the payment processing service…

… has found its calling in multiple industries. One such is banking, as it actually makes use of the established and matured banking system as we know it in order to perform its operations. What Inpay does is advance the regular banking system, providing better payment processing time, even greater security and compliance among other features, as well as expanding the existing banking network to new territories.

Aside from banking…

… B2B and B2C payments have also benefited greatly from the service. The former assists businesses greatly in allowing them to perform payments between them without fear of not being compliant to the specific legal regulations. As for payments made to customers, mostly in the form of disbursements, payrolls, supplier payouts and settlements, this service is most advantageous due to its streamlined, yet fully optimized transactions.

E-commerce businesses…

… also benefit from the payment method, especially due to the multiple integration options it has on offer. These online merchants base their operations on the ability to process payments from customers as fast as possible, and this service enables them to do this. E-commerce platforms can choose between an:

- Express;

- White Collar, and

- Bespoke solution.

Each of these is easily integrated into the existing platform that your specific e-commerce business runs on, benefiting them in a unique way. The express option will allow merchants to provide their customers with a direct link to the Inpay website where they will be instantly able to complete payment through their familiar online banking platform.

Alternatively, the white collar option…

… is an integrated version that is most suitable for businesses that pack a knowledgeable IT team which can work with the provided API. While it may seem more complex, it still ends up offering a straightforward payment method, only with the potential to choose its features. Ultimately, the bespoke solution is, as the name suggests, tailored to the needs of the specific e-merchant, providing them with a most dedicated way of addressing the needs of their customer base.

Transactions for NGOs…

… are also supported by the service, all in order to get the funds as quick, easy and in the largest quantity available. These are a specific type of operations, with the focus being on benefitting BG budgets rather than profiting from the payment processing service they provide.

Making a Deposit with Inpay

You are now familiar with the principle of operations used by the payment processing service in order to perform such fast, secure and convenient transactions worldwide. All you have to do now is find a suitable Inpay online casino site and register on it for a player account.

You are now familiar with the principle of operations used by the payment processing service in order to perform such fast, secure and convenient transactions worldwide. All you have to do now is find a suitable Inpay online casino site and register on it for a player account.

- Considering the fact that you don’t even need to register beforehand for an official account with the financial service, all it takes is to head to the casino lobby and find the banking page. Here, click on the Inpay logo in the deposit methods section, choose your country of residence (or the country where your bank is located) and the specific bank out of the list of partnering institutions.

- Once you have completed this preliminary step, the merchant, in this case, the online casino, will generate a full list of payment details that you will need in order to complete the transaction through the specific bank. Bear in mind that you will need to input the amount you are planning to deposit into the player account as well.

- These details are all you need now in order to complete the transfer. Head straight into your familiar online banking page from the specific bank you have entered, and make an online transaction using the details.

- Afterward, the Inpay service will register the request for a transaction to the specific online casino account. It will record it in their centralised register, and send the information further to the account the service holds in the specific country where the casino is based. Here, the respective Inpay banking account will complete the transfer with its own disposable funds straight into the casino account, using nothing more than the simple local banking functionality.

While it seems…

… like a lengthy transfer, the fact that all this is registered and processed in real time makes for an almost instantaneous transaction. Hence, players should complete the deposit request and see their funds credited into their online casino player account in virtually seconds. After that, all that is left is to head back to the lobby and choose from your favourite blackjack or roulette tables, as well as slot titles or other game variants.

Making a Withdrawal with Inpay

The service does offer payments…

… to and from business establishments, but when it comes to online casino withdrawals, players will need to seek out an alternative solution. Considering that you have been lucky enough to hit a significant win, as well as use the Inpay payment processing service for deposits, this shortcoming shouldn’t drastically reduce your enjoyment at the chosen online casino platform.

In fact, when it comes to withdrawing…

… from online casinos where you have deposited with Inpay, you are still bound to have a myriad of options. After all, the operator’s partnership with the service is indicator enough of its reliability, so you can be sure to remain compliant with all security standards and regulations even when switching to a different banking method for your cashout request.

More traditionally oriented players can stick to their online banking service, and request a withdrawal straight into their account without an intermediary such as Inpay. Otherwise, they can opt for some of the more modern solutions, such as an e-wallet, online payment gateway and even cryptocurrencies – Bitcoin, Ethereum, Litecoin and more.

Advantages of Inpay Online Casino Payments

The Inpay online casino payment method is definitely among the best options available to players at these top gambling platforms. These are some of the advantages you are bound to experience during your time with Inpay online casino deposits, or other payments made using the service.

The Inpay online casino payment method is definitely among the best options available to players at these top gambling platforms. These are some of the advantages you are bound to experience during your time with Inpay online casino deposits, or other payments made using the service.

- Security – The service places great emphasis on security, which is more than evident in their partnering with some of the most secure and affirmed institutions globally – banks and the likes. However, when it comes to this feature, Inpay goes way beyond a secure partner and reliable encryption. They dedicate a great deal of attention to fraudulent activities and their prevention, as well as compliance with the legal systems and regulations of the specific jurisdictions where they are present. On top of this, they guarantee additional compliance with specific requirements that ensure integrity of the financial industry as a whole, starting from Know Your Customer provisions and Anti-Money Laundering policies, to the Wolfsberg All of these are addressed in greater detail below, so you can gain significant insight into the specific mechanics protecting and safeguarding your funds at all times.

- Accessibility – There is no denying the accessibility of the service, as it is able to cater to users from over 60 countries till date. With an extensive user base, and suitable features to reach greater progress and expansion in the coming future, Inpay’s accessibility and numerous partnerships with establishments definitely prove its massive potential.

- Functionality – The multiple functionality capabilities of the service are an added advantage and one that actually serves to support and further advance its accessibility. In other words, the main operation performed by Inpay is payment processing; nevertheless, all payments are specific in their own way, and this service manages to incorporate multiple functionalities in their centralized management method in order to serve both businesses and NGOs, e-merchant transactions and specific B2B and disbursement payments.

- Convenience – Inpay users are bound to prefer this payment method over many others when it comes to all their online payment processing needs. Hence, it is greatly convenient for them when they are able to find it as an eligible option on all their major e-commerce platforms. This contributes to more than just a formal switch from one payment method to another – users will not need to bother learning how to operate with a different method in most situations, nor will they be subject to any additional fees for transferring funds between eligible an ineligible methods.

- Ease of Use – The ease of use cannot be stressed enough when it comes to this payment processing option. After all, their operations are based on the mature, perfected and greatly accepted banking network that has been in existence for much longer than the online payment industry on the whole. It banks on the users’ familiarity with their usual online banking services and the trust users hold for them, making the most of both worlds.

- Fees Policy – Ultimately, the fees mentioned above are also a consideration for this payment method. Users choosing to perform their online transactions through Inpay are exempt from all fee charges, and only the businesses which are featuring this option on their specific platforms will face a charge for the service. This is most convenient for the online player pool, since they are practically looking to make the most with the bankrolls they have, and would likely stay away from online banking methods that charge a fee on each of their deposits.

Disadvantages of Inpay Online Casino Payments

- Withdrawal Restriction – The fact that withdrawals are yet to be included in the list of Inpay online casino functionalities is both an advantage and a drawback. After all, the matter of interactive gambling as a new industry is still to be clearly resolved in many jurisdictions worldwide, which is why the service, in an attempt to remain compliant with the legal provisions at all times, has shun from this functionality.

Nevertheless, online casino players looking for a comprehensive payment processing solution still consider it to be a shortcoming; they prefer comprehensive options that save them the time and fee charges for additional registration, transaction charges and possible currency conversion and other fees.

- Restricted Countries – With all the countries listed above, and more that are part of the Inpay network, there is still a wide marketplace left waiting to be serviced by this company. Residents of these countries consider their exclusion to be a disadvantage, even though Inpay stays firm in its principles of expansion – the company avoids jurisdictions which do not comply with their highest standards of security and could potentially compromise operations in the remaining marketplaces.

Security

The payment processing service has set up a whole page on its website specifically dedicated to all the standards that it is compliant with in order to set their users’ minds at ease. While this is becoming a more and more common practice, not all services can actually boast of the range of compliance achieved by Inpay.

For starters…

… the solution is fully compliant with the Wolfsberg principles – a set of principles set out by financial institutions globally. These serve to denote the mandatory features of a specific payment processor in order to provide a satisfactory service to its clients and thus retain reputability of the practice as a whole. In terms of this payment company specifically, both the partners and its internal organization are compliant with the principles, and even undergo regular reviews to ensure consistency.

Fraud…

… has also been addressed as a major issue in their line of work; Inpay has a whole fraud detection network of procedures, tracking down information all the way from the true originator of the funds to the final beneficiary. What is more, the company has a whole team employing all kinds of precautions – encryption, antivirus and dual-factor authentication procedures among the rest in order to restrict any potential third-party interference.

Their governance and risk management practices…

… further build upon its security, with the former establishing the service as a unique centralized network with a reporting capability. As for the later, risk management, the company has a wholly dedicated set of tools, support and cooperation with other leading services in order to ensure risk is at an all-time low.

Ultimately, when it comes to compliance…

… the payment service boasts of following the principles of numerous security regulations and requirements. As listed on the official page, they meet and even exceed compliance in some cases in regard to the following standards:

- Anti-Money Laundering (AML)

- Counter Terrorist Funding (CTF)

- Know Your Customer (KYC)

- Politically Exposed Person Lists (PEPs)

They meet the requirements of the Danish FSA…

… as mentioned earlier, and even further comply with the EU standards for online payment processing. This includes transferring funds between residents of EU and non-EU member states across Europe, which is a much-welcomed advantage that isn’t offered by too many payment processors as of yet.

Customer Support

In terms of customer service and support…

In terms of customer service and support…

… the company does not fall short from the excellence established in other aspects of its operations. They offer full support to all their international users at all four locations where they hold an official office – London, Manila, Singapore and their headquarters in Copenhagen. Apart from these, there are the added email contact options for potential partners and users, as well as existing clients, depending on their issue or inquiry.

Inpay finally provides a rather extensive knowledgebase in their FAQ section – the page distinguishes each visitor according to their interests and profile and directs them to the specific set of frequently asked questions which could be of service.

Conclusion

Evidently, Inpay…

… is an instance of the latest generation of online payment processing options, but unique in its approach. The service aims to provide their users with the best of banks and tech advancements, and does it in a most convenient, secure and speedy way through their centralized reporting and big-data management system.

Online casino players particularly benefit from the service’s ability to process all kinds of international payments. The fact that there are no minimum or maximum amount limits further benefits their online casino experience, allowing them to focus on any specific casino requirements that could be present.

All this…

… along with the lack of fees for all transactions, ultimately result in a most satisfactory online casino gameplay experience, regardless of your wins and losses.

- American Express

- Apple Pay Casinos

- AstroPay Card Casinos

- Bank Wire Transfer Casinos

- BankID Casinos

- Bitcoin Cash Casinos

- Bitcoin Casino Sites

- Blue Rewards Card Casinos

- Brite Casinos

- Canadian Online Casinos With eCheck

- Canadian Online Casinos with EcoPayz

- Canadian Online Casinos With Flexepin

- Canadian Online Casinos With Gigadat

- Canadian Online Casinos With iDebit

- Canadian Online Casinos With InstaDebit

- Canadian Online Casinos With Interac Online

- Canadian Online Casinos With MuchBetter

- Canadian Online Casinos With Vanilla Prepaid

- Cardano Casinos

- CashToCode Casino Sites

- Check/Cheque Casinos

- Dash Casinos

- Diners Club Casinos

- Discover card Casinos

- Dogecoin Casinos

- EOS Casinos

- ePay Casinos

- Ethereum Casinos

- eZeeWallet

- FUN Token Casinos

- Giropay Casinos

- Google Pay Casinos

- JCB Casinos

- Jeton Casinos

- KoalaPays Casinos

- Litecoin Casinos

- Maestro Casinos

- MasterCard Casinos

- MasterCard Casinos

- MasterCard Debit Casinos

- Mifinity Casinos

- Money Transfer Casinos

- MoneyGram Casinos

- MoonPay Casinos

- Neo Casinos

- Neosurf Casinos

- Neteller Casinos

- Noda Pay Casinos

- Nordea Casinos

- Online Bank Transfer Casinos

- Online Casinos With Boku in Canada

- Online Casinos With Citadel Instant Banking

- Online Casinos With Online Banking

- Online Casinos With Paysafecard

- Online Casinos With Prepaid Cards

- Pay ID Casinos

- PayPal Casinos

- Paytrail Casinos

- Payz Casinos

- Perfect Money Casinos

- Polkadot Casinos

- PremierPay Casinos

- PugglePay Casinos

- QIWI Casinos

- Quickbit Casinos

- Remitly Casinos

- Ria Casinos

- Siirto Casinos

- Skrill Casinos

- Solana Casinos

- STICPAY Casinos

- Tether Casinos

- Trustly Casinos

- UnionPay Casinos

- UPayCard Casinos

- USDC Casinos

- VISA Casinos

- VISA Debit Casinos

- VISA Electron Casinos

- Voucher Casinos

- WebMoney Casinos

- Western Union Casinos

- Zelle Casinos