Recently, New York Comptroller Thomas DiNapoli issued a report that studied the economic impact of the state’s four licensed commercial casinos in the upstate region. It found that the four gaming locations delivered US$176 million in non-tax gaming revenue for the local governments between 2017 and 2022. But only three smaller towns saw a significant financial benefit.

It should be explained that the four commercial casinos in upstate New York are — del Lago Resort and Casino in Tyre, Rivers Casino and Resort in Schenectady, Resorts World Catskills in Thompson and Tioga Downs Casino in Nichols. The Empire State will also issue three commercial gaming licenses for the downstate region, but those should be announced later in 2023.

Not Instant Fix to Fiscal Problems

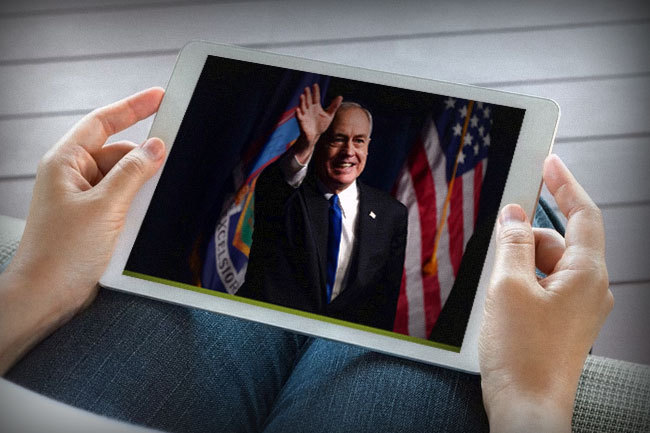

Mr. DiNapoli commented casinos are not an instant fix to solve financial challenges, and noted that while they have generated plenty of tax revenue, the impacts differ for communities that receive such proceeds. He is hopeful that the report will give state and local officials a new perspective that can help host communities avoid misguided expectations of the public positives of casinos.

The report found that in 2020 all four casinos failed to meet the projected gross revenue targets. According to the study, these proceeds and tax contributions continue to underperform three years later, while only reaching 50-60% of the expectations. The comptroller noted that the only exception at that time was Tioga Downs in the Southern Tier.

But despite the failure to meet targets, local governments still benefitted from the casinos. In the three smaller host towns, Nichols, Tyre, and Thompson, gambling revenue contributed 30% to 60% of total revenue, allowing them to cut property taxes. But in the largest host community, Schenectady, and four host counties, gaming tax accounted for 1-3% of their total proceeds.

Mr. DiNapoli pointed out that the lockdown of businesses in 2020 was a big factor in the shortfall of revenue, but the four casinos saw gross gaming revenue that exceeded the pre-unprecedented situation levels in 2022. Still, changes to the state’s gaming law allow casinos to keep a larger portion of GGR, meaning that this did not help in bringing greater local gaming taxes.

Working on Downstate Casino Expansion

In the meantime, the Empire State is in the process of awarding the rest three commercial gaming licenses which are assigned to downstate New York. This January, the Gaming Location Facility Board started the Request for Applications, which will allow it to hear proposals from third-party companies who wish to apply for one of the three available licenses.

One of the corporations interested in joining the downstate casino landscape in New York is Las Vegas Sands. And according to, Wells Fargo analyst Daniel Politzer, the operator’s proposal for a multi-billion casino resort in Nassau County is among the favourites. He noted that this was due to the scale of its project, track record, and ability to collaborate well with local communities.

Source: Trunick, Keegan and Camera, John “New York comptroller releases report detailing revenue impact of state’s casinos” Spectrum News 1, August 3, 2023